The Heterogeneous Consequences of Reduced Labor Costs on Firm Productivity

Joint work with Francesco Del Prato; VisitINPS 2020 project. Under review.

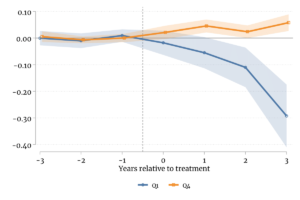

Abstract. We explore the effect of a reduction in overall labor costs, indirectly induced by an Italian reform that weakened employment protection legislation, on the productivity distribution of manufacturing firms. Due to the unique institutional features of the Italian collective bargaining system, in the manufacturing sector the reform led to a clean reduction in average worker compensation, without altering the average structure of employment relationships. This decrease in labor cost resulted in a reduction in average total factor productivity (TFP) among less productive firms, and an increase at the upper end of the distribution. We pair these findings with increased entry and exit dynamics among low-productivity firms, suggesting the presence of an adverse selection mechanism at the bottom of the TFP distribution, enhanced by the reform. We formalize this concept via a general equilibrium model that links productivity to frictions in the markets for inputs.

Abstract. We explore the effect of a reduction in overall labor costs, indirectly induced by an Italian reform that weakened employment protection legislation, on the productivity distribution of manufacturing firms. Due to the unique institutional features of the Italian collective bargaining system, in the manufacturing sector the reform led to a clean reduction in average worker compensation, without altering the average structure of employment relationships. This decrease in labor cost resulted in a reduction in average total factor productivity (TFP) among less productive firms, and an increase at the upper end of the distribution. We pair these findings with increased entry and exit dynamics among low-productivity firms, suggesting the presence of an adverse selection mechanism at the bottom of the TFP distribution, enhanced by the reform. We formalize this concept via a general equilibrium model that links productivity to frictions in the markets for inputs.