Published in: the Review of Economic Studies, 84(7), July 2020 (pp. 1989-2018)

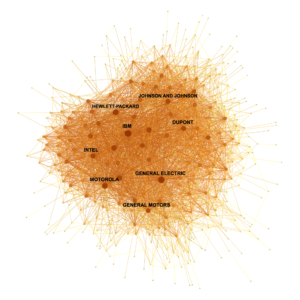

Abstract. In this article, I directly test the hypothesis that interactions between inventors of different firms drive knowledge spillovers. I construct a network of publicly traded companies in which each link is a function of the relative proportion of two firms’ inventors who have former patent collaborators in both organizations. I use this measure to weigh the impact of R&D performed by each firm on the productivity and innovation outcomes of its network linkages. An empirical concern is that the resulting estimates may reflect unobserved, simultaneous determinants of firm performance, network connections, and external R&D. I address this problem with an innovative IV strategy, motivated by a game-theoretic model of firm interaction. I instrument the R&D of one firm’s connections with that of other firms that are sufficiently distant in network space. With the resulting spillover estimates, I calculate that among firms connected to the network the marginal social return of R&D amounts to approximately 112% of the marginal private return.

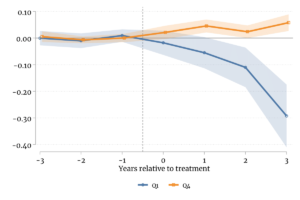

Abstract. We explore the effect of a reduction in overall labor costs, indirectly induced by an Italian reform that weakened employment protection legislation, on the productivity distribution of manufacturing firms. Due to the unique institutional features of the Italian collective bargaining system, in the manufacturing sector the reform led to a clean reduction in average worker compensation, without altering the average structure of employment relationships. This decrease in labor cost resulted in a reduction in average total factor productivity (TFP) among less productive firms, and an increase at the upper end of the distribution. We pair these findings with increased entry and exit dynamics among low-productivity firms, suggesting the presence of an adverse selection mechanism at the bottom of the TFP distribution, enhanced by the reform. We formalize this concept via a general equilibrium model that links productivity to frictions in the markets for inputs.

Abstract. We explore the effect of a reduction in overall labor costs, indirectly induced by an Italian reform that weakened employment protection legislation, on the productivity distribution of manufacturing firms. Due to the unique institutional features of the Italian collective bargaining system, in the manufacturing sector the reform led to a clean reduction in average worker compensation, without altering the average structure of employment relationships. This decrease in labor cost resulted in a reduction in average total factor productivity (TFP) among less productive firms, and an increase at the upper end of the distribution. We pair these findings with increased entry and exit dynamics among low-productivity firms, suggesting the presence of an adverse selection mechanism at the bottom of the TFP distribution, enhanced by the reform. We formalize this concept via a general equilibrium model that links productivity to frictions in the markets for inputs.