Joint work with Santiago Pereda Fernández. Revision requested at Econometric Reviews.

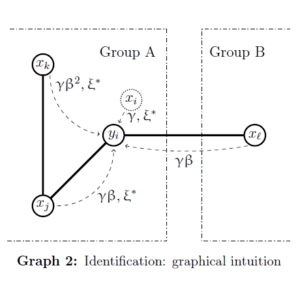

Abstract. Conventional methods for the estimation of peer, social or network effects are invalid if individual unobservables and covariates correlate across observations. In this paper we characterize the identification conditions for consistently estimating all the parameters of a spatially autoregressive or linear-in-means model when the structure of social or peer effects is exogenous, but the observed and unobserved characteristics of agents are cross-correlated over some given metric space. We show that identification is possible if the network of social interactions is non-overlapping up to enough degrees of separation, and the spatial matrix that characterizes the co-dependence of individual unobservables and covariates is known up to a multiplicative constant. We propose a GMM approach for the estimation of the model’s parameters, and we evaluate its performance through Monte Carlo simulations. Finally, we show that in a typical empirical application about classmates our approach might estimate statistically non-significant peer effects when conventional approaches register them as significant

Abstract. Conventional methods for the estimation of peer, social or network effects are invalid if individual unobservables and covariates correlate across observations. In this paper we characterize the identification conditions for consistently estimating all the parameters of a spatially autoregressive or linear-in-means model when the structure of social or peer effects is exogenous, but the observed and unobserved characteristics of agents are cross-correlated over some given metric space. We show that identification is possible if the network of social interactions is non-overlapping up to enough degrees of separation, and the spatial matrix that characterizes the co-dependence of individual unobservables and covariates is known up to a multiplicative constant. We propose a GMM approach for the estimation of the model’s parameters, and we evaluate its performance through Monte Carlo simulations. Finally, we show that in a typical empirical application about classmates our approach might estimate statistically non-significant peer effects when conventional approaches register them as significant